Hey folks

After spending way too much time comparing all the big names in the Gold IRA space, I wanted to share why I finally went with Augusta Precious Metals — and why I think they’re by far the best choice if you’re serious about protecting your retirement with real, physical gold or silver.

I looked at Goldco, Noble Gold, Birch Gold, Lear Capital… even some of the crypto-backed alternatives. But Augusta stood out like a beacon of calm in a sea of hype.

But Augusta Precious Metals?

They offered me a free 1-on-1 web session with a Harvard-trained economist who walked me through:

At the end of the session, I felt empowered instead of pitched. And that’s exactly why I chose them.

I pictured paperwork nightmares, long calls with my old custodian, and weeks of delays.

But Augusta’s team literally held my hand the entire way. From custodian coordination to account setup to metal selection — they handled it all.

It took less than 10 days from start to finish. And I got a full confirmation once the metals were securely stored in my chosen depository (I went with Delaware). ️

Physical gold, on the other hand, doesn’t vanish when the stock market drops 30%.

With Augusta Precious Metals, your metals are:

They give you exact pricing before you invest:

The guide breaks down:

No call centers. No re-explaining your history to new reps every time.

I’ve had multiple follow-ups, and every time I spoke to the same guy, who remembered every detail from our first call. That’s a level of consistency I didn’t find at Goldco or Noble.

They don’t cater to bargain hunters looking to invest $5K.

But if you’re rolling over $50K+, are worried about inflation, and want transparency and lifetime service, then Augusta is the best in the industry, period.

Here’s why I picked them:

I waited way too long before acting — but once I did, I felt 10x more secure knowing that part of my retirement is now backed by real gold, not promises.

Take the first step like I did — grab their free guide and schedule a call. You don’t have to commit, and they won’t pressure you.

But it might be the smartest 20 minutes you spend this year.

Let me know if you’ve worked with Augusta Precious Metals too — or if you’re comparing options. Happy to share more about what I learned.

After spending way too much time comparing all the big names in the Gold IRA space, I wanted to share why I finally went with Augusta Precious Metals — and why I think they’re by far the best choice if you’re serious about protecting your retirement with real, physical gold or silver.

I looked at Goldco, Noble Gold, Birch Gold, Lear Capital… even some of the crypto-backed alternatives. But Augusta stood out like a beacon of calm in a sea of hype.

If you’re looking for a no-pressure, ultra-professional, and educational-first approach — you’re going to want to read this.

What Made Augusta Different from Day One

Every other company I spoke with wanted to sell me immediately.But Augusta Precious Metals?

They offered me a free 1-on-1 web session with a Harvard-trained economist who walked me through:

- How Gold IRAs work

- Why inflation is eating up traditional retirement accounts

- How physical gold preserves purchasing power

- And why Augusta doesn’t push risky collectibles or upsells

At the end of the session, I felt empowered instead of pitched. And that’s exactly why I chose them.

Who Augusta Precious Metals Is Perfect For

If you’re someone who:- Wants high-trust, long-term investing, not flashy sales

- Is rolling over $50K+ and wants a smooth, transparent process

- Values white-glove service and lifetime support

- Is tired of financial advisors who can’t explain anything clearly

The Rollover Experience: Smooth & Stress-Free

One of the things I dreaded was the actual 401(k) rollover process.I pictured paperwork nightmares, long calls with my old custodian, and weeks of delays.

But Augusta’s team literally held my hand the entire way. From custodian coordination to account setup to metal selection — they handled it all.

It took less than 10 days from start to finish. And I got a full confirmation once the metals were securely stored in my chosen depository (I went with Delaware). ️

Everything was insured, segregated, and tracked.

️ Real Metal, Real Vault, Real Protection

Let’s be honest. Most retirement accounts are loaded with paper assets — stocks, bonds, mutual funds — all vulnerable to crashes.Physical gold, on the other hand, doesn’t vanish when the stock market drops 30%.

With Augusta Precious Metals, your metals are:

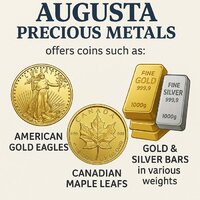

- IRS-approved (99.5% purity minimum)

- Stored in private, insured, and secure depositories

- Held in segregated accounts, not commingled

- Audited and fully verified

The Transparency Was Next-Level

One of the main reasons I went with Augusta is their zero-fee surprise policy.They give you exact pricing before you invest:

- One-time setup fee

- Annual custodian fee

- Storage fee

- No hidden transaction costs or vague “management charges”

I Downloaded Their Free Gold IRA Guide First

Before I even spoke with anyone, I grabbed their free info kit — and I recommend you do the same if you’re even thinking about gold.The guide breaks down:

- How to legally rollover your 401(k) or IRA without tax penalties

- Which gold and silver products are eligible

- What mistakes to avoid (including home storage )

- How Augusta handles compliance and long-term support

The Lifetime Support Is Real

Once you become a customer, you’re assigned a personal rep — and that person stays with you forever.No call centers. No re-explaining your history to new reps every time.

I’ve had multiple follow-ups, and every time I spoke to the same guy, who remembered every detail from our first call. That’s a level of consistency I didn’t find at Goldco or Noble.

Why I Recommend Augusta Over Other Options

Let me just be real with you — Augusta Precious Metals isn’t for everyone.They don’t cater to bargain hunters looking to invest $5K.

But if you’re rolling over $50K+, are worried about inflation, and want transparency and lifetime service, then Augusta is the best in the industry, period.

Here’s why I picked them:

- Highest-rated company for trust and compliance

- Free Harvard-trained education session

- White-glove IRA rollover support

- Segregated, insured storage

- Zero sales pressure

- Lifetime customer support

Final Thoughts – Don’t Wait for the Next Crash

If you’re reading this, you’re probably already worried about the markets, inflation, or just feeling stuck with your 401(k).I waited way too long before acting — but once I did, I felt 10x more secure knowing that part of my retirement is now backed by real gold, not promises.

Take the first step like I did — grab their free guide and schedule a call. You don’t have to commit, and they won’t pressure you.

But it might be the smartest 20 minutes you spend this year.

Let me know if you’ve worked with Augusta Precious Metals too — or if you’re comparing options. Happy to share more about what I learned.

Last edited: