Thinking about adding physical gold or silver to your retirement savings? In this detailed GoldenCrest Metals review, we take a close look at one of the rising providers of precious metals IRAs in 2025.

With ongoing economic uncertainty and market volatility, many retirement savers are exploring alternatives that provide long-term stability. GoldenCrest Metals has positioned itself as an educational and transparent option for those looking to diversify with physical gold or silver.

️Who Is GoldenCrest Metals?

GoldenCrest Metals is a U.S.-based precious metals dealer that helps retirement-focused buyers access physical gold and silver through self-directed IRAs. While relatively new to the scene compared to legacy brands like Lear Capital or Colonial Metals Group, GoldenCrest has earned attention in 2025 for its educational approach, streamlined setup, and honest communication.

Their main offerings include:

- Gold and silver coins eligible for IRA use

- Secure storage with trusted vaulting partners

- A free Gold IRA kit packed with information about how to get started

- Support from precious metals specialists (not financial advisors)

GoldenCrest does not offer financial advice or stock market products. Instead, they focus exclusively on helping buyers protect their purchasing power through tangible assets like physical gold.

What Makes GoldenCrest Metals Stand Out in 2025?

In a crowded field of precious metals companies, GoldenCrest Metals has started to carve out its reputation by focusing on education, transparency, and service for retirement-focused buyers. While they might not yet have the brand legacy of Lear Capital or Birch Gold Group, they are making an impression where it counts.

Here are a few standout features:

- No pushy sales tactics. Buyers consistently report that GoldenCrest Metals provides straightforward information without pressure to act quickly.

- Educational focus. Their Gold IRA kit is packed with valuable knowledge for those unfamiliar with physical gold, silver, or IRA rollovers.

- Fast processing and delivery. GoldenCrest boasts quick IRA setup timelines and prompt metals shipment once the account is funded.

- Clear fee structure. Unlike some competitors, their costs are explained in detail up front—with no hidden surprises.

- Responsive support. Retirement savers can speak with precious metals experts (not investment advisors) who understand the process and can walk you through every step.

Whether you're rolling over an existing retirement plan or starting fresh with a self-directed gold IRA, GoldenCrest Metals positions itself as a buyer-first company—and that's winning them attention in 2025.

GoldenCrest Metals Fees and Transparency

Understanding the costs of working with any gold company is essential. GoldenCrest Metals takes pride in offering a simple and transparent fee structure that avoids the confusion or opacity found with some providers.

Here’s what you can expect:

- Setup fee: One-time fee when opening a new account (usually waived with qualifying rollover amounts).

- Storage fees: Annual vault storage with segregated or non-segregated options.

- Maintenance fees: Covers account handling, reporting, and compliance.

These rates are competitive when compared with other top-rated companies like Noble Gold, Colonial Metals, or Birch Gold Group. GoldenCrest also publishes these fees clearly—buyers won’t be hit with surprise charges later.

What’s Included in the GoldenCrest Metals Gold IRA Kit?

GoldenCrest offers a free Gold IRA kit to help new buyers better understand their options. This isn't a sales pitch—it’s an educational resource that covers:

- How a gold or silver IRA works

- Types of precious metals you can include

- Steps to roll over or fund a new account

- Secure storage options explained

- Benefits of diversifying with gold and silver

Requesting this kit is a no-obligation way to learn the basics—perfect for anyone just starting to explore physical gold.

Precious Metal Bullion Available at GoldenCrestMetals.com

Gold:

- American Gold Eagle: Most popular U.S. coin, highly liquid

- Canadian Maple Leaf: 99.99% pure gold, detailed design

- Gold Bars: Sizes from 1 oz to 100 oz from top refiners

- Austrian Philharmonic: Well-known European coin

Silver:

- American Silver Eagle: Backed by U.S. government

- Canadian Maple Leaf: 99.99% purity, iconic look

- Silver Bars: 1–100 oz, cost-effective bulk options

- Australian Kangaroo: Detailed design, popular with collectors

Platinum:

- American Platinum Eagle: Official U.S. platinum coin

- Canadian Maple Leaf: 99.95% purity, great for portfolio mix

- Platinum Bars: Available in 1 oz size

Palladium:

- American Palladium Eagle: Ideal for diversification

- Canadian Maple Leaf: High purity and strong global recognition

- Palladium Bars: Simple way to invest in palladium

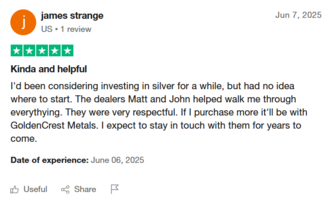

What Are Retirement Savers Saying About GoldenCrest Metals?

GoldenCrest Metals has earned a solid reputation among retirement-minded buyers who want to add physical gold or silver to their portfolios. Across forums, review sites, and feedback platforms, one theme stands out: they prioritize education over sales pressure.

Common praise includes:

- Helpful and knowledgeable precious metals experts

- No aggressive upselling

- Quick response times

- Step-by-step guidance for first-time gold IRA buyers

- Clear explanations of rollover and storage options

On the Better Business Bureau (BBB), GoldenCrest currently holds a positive rating, with minimal complaints.

GoldenCrest vs Other Gold IRA Providers in 2025

GoldenCrest vs Other Gold IRA Providers in 2025

GoldenCrest Metals vs Noble Gold

Noble Gold offers excellent customer support and a low minimum investment. GoldenCrest, however, tends to be more education-focused and provides a more transparent breakdown of storage and setup costs.

GoldenCrest Metals vs Birch Gold Group

Birch Gold has strong brand recognition and a longer history. But GoldenCrest often receives praise for a more personal, hands-on approach.

GoldenCrest Metals vs Colonial Metals Group

Colonial Metals is known for speed and simplified setup. GoldenCrest offers more robust education upfront and a clearly structured gold IRA kit.

GoldenCrest Metals vs Lear Capital

Lear has had mixed feedback over the years. GoldenCrest’s open fee structure and smaller team may appeal more to retirement savers seeking clarity.

Pros and Cons of GoldenCrest Metals

Pros:

- Transparent fee structure

- Excellent educational resources

- No high-pressure tactics

- Quick IRA setup and delivery

- Positive BBB and TrustPilot reviews

- Supportive specialists

Cons:

- Newer company

- Fewer reviews than larger competitors

- Limited selection of metals

Final Verdict: Should You Consider GoldenCrest Metals in 2025?

GoldenCrest Metals is a trustworthy and education-first option in the gold IRA space. Their low-pressure, informative approach makes them a top pick for 2025.

How to Get Your Free Gold IRA Kit from GoldenCrest Metals

Click here to request your Gold IRA kit

Click here to request your Gold IRA kit

- Step-by-step rollover guidance

- Gold and silver options

- Storage details

- IRA education

goldencrestmetals.com - 23901 Calabasas Road Suite 2002 Calabasas, CA 91302 - 833-426-3825Disclaimer: Some of the links in this article are affiliate links, which means we may earn a commission if you click and make a purchase or submit your information. This comes at no additional cost to you and helps support our work.