As someone who has worked with multiple retirement planning options, including both Gold IRAs and Roth IRAs, I want to offer a practical overview to help others evaluate their options clearly.

This post outlines the key differences, tax structures, pros and cons, and when each account type may be suitable. I’ll also include a list of reputable providers I've vetted personally or through peer recommendations, in case you're ready to set one up.

What’s the Core Difference?

At a high level:

- Gold IRA: Self-directed IRA that holds physical metals like gold, silver, platinum, and palladium. Offers diversification and a hedge against inflation.

- Roth IRA: Holds traditional investments (stocks, bonds, mutual funds) and offers tax-free withdrawals in retirement. Contributions are made with after-tax dollars.

Recommended Gold IRA Providers in 2025

If you’re considering opening a Gold IRA, make sure you choose a provider that is IRS-compliant, transparent about fees, and offers proper custodianship and storage.Here are six companies that meet those criteria and have positive industry reputations(

- Augusta Precious Metals -

(4.9/5)

(4.9/5)

Specializes in retirement-focused gold and silver IRAs with a strong emphasis on 1-on-1 education. No high-pressure tactics and clear fee structure. Recommended for investors starting with $50,000+. Sign up here to download the free IRA Kit

- Goldco -

✩ (4.3/5)

✩ (4.3/5)

One of the most balanced companies for both new and experienced investors. Offers extensive educational resources and supports 401(k) rollovers into Gold IRAs. Entry starts at $25,000.

- Birch Gold Group -

✩✩ (3.9/5)

✩✩ (3.9/5)

Strong educational focus with low minimums (~$10,000). Provides access to gold, silver, palladium, and platinum. Good for those who want a broader metal selection and no-nonsense consultations.

- Noble Gold Investments -

✩✩ (3.7/5)

✩✩ (3.7/5)

Known for being beginner-friendly. Minimum investment is $10,000, and the company offers transparent buyback options and solid customer support. Also offers rare coins and cryptocurrency IRAs.

- Preserve Gold -

✩✩ (3.5/5)

✩✩ (3.5/5)

A modern option with fast digital onboarding and strong client service. Lower barriers to entry make it accessible, and setup can often be completed within two weeks. Great for first-time gold investors.

- Lear Capital -

✩✩✩ (3.2/5)

✩✩✩ (3.2/5)

Established brand with over 25 years in the business. Offers a wide array of precious metals and supports both IRAs and direct metal purchases. Suitable for investors who want maximum product variety.

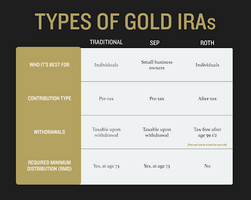

Contribution and Tax Comparison

- Gold IRA contributions are typically pre-tax (like Traditional IRAs) and grow tax-deferred. Taxes apply upon withdrawal.

- Roth IRA contributions are made with after-tax dollars, but all qualified withdrawals in retirement are 100% tax-free.

Note: Gold IRAs don’t have income limits. Roth IRAs do, which may exclude higher earners.

Pros and Cons of Each

Gold IRA Pros:

- Hedge against market volatility

- Diversification with tangible assets

- No income limits to open an account

- Physical metals can preserve wealth long-term

- Storage and custodial fees apply

- Does not generate dividends or yield

- Less liquid than traditional assets

- Tax-free growth and withdrawals

- No required minimum distributions (RMDs)

- Greater liquidity and investment variety

- Contributions not tax-deductible

- Income limits restrict participation

- Market exposure may increase risk

* Auguta Preciou Metals is my bet choice in 2025. Download free GOLD IRA kit

When to Choose Each

Gold IRA may be more suitable if:- You're concerned about inflation or global instability

- You want to diversify beyond the stock market

- You’re a high-income earner not eligible for Roth IRA contributions

- You plan to hold long-term and aren’t relying on short-term yield

- You’re expecting to be in a higher tax bracket in retirement

- You want maximum liquidity

- You prefer stocks, mutual funds, or ETFs

- You qualify under the income threshold for direct contributions

Goldco is a well-trusted company to consider if you’re looking to diversify your retirement portfolio with physical gold and silver

How to Proceed

Before making any decision:- Compare fee structures (setup + annual maintenance + storage)

- Ask about the custodian and IRS-approved storage facility

- Confirm buyback guarantees and liquidation policies

- Order the free Gold IRA kits from 2–3 providers to review educational materials and disclosures side by side

Each of the above-listed companies offers a free investor guide that outlines how to transfer or roll over retirement funds into precious metals. The best ones according to the ratings, customer experience, and long-term reputation are Augusta Precious Metals and Goldco.

Both have A+ ratings with the BBB, strong educational programs, and clear fee structures. Augusta is known for its one-on-one consultations and focus on retirement planning, while Goldco is a top choice for both new and experienced investors looking for a well-rounded service and fast account setup.

If you’re starting your research, requesting the free investor kits from these two companies is a good first step.

Summary Guidance

If you're a high-income individual or someone looking for long-term portfolio protection from inflation, a Gold IRA with a provider like Augusta Precious Metals or Goldco may align better with your goals.If you're still eligible for Roth contributions and prefer a more liquid, tax-free growth environment, a Roth IRA is worth exploring through your brokerage or financial advisor.

Those who want diversification can hold both — using a Roth IRA for growth and a Gold IRA for stability.

Disclosure:

This article is for informational purposes only and does not constitute financial or investment advice. The author may receive compensation from some of the companies mentioned if you choose to invest through the provided links. This does not influence the rankings or evaluations. All providers listed are believed to be IRS-compliant and operate with approved custodians and depositories as of 2025. Consult with a licensed financial advisor before making retirement account decisions.

Last edited: